What Is a Tax Bracket Select the Best Answer

Select the best answer below the Federal Reserve. Select the best answer below O A.

The form used to file taxes D.

. Joel is in a 33 tax bracket. The lowest tax bracket is for filers who earn 9875 or less youll pay a flat rate of 10 if your income falls within this range. Most people when asked what their tax bracket is if they answer at all will mention the bracket at which their last dollar of income or their next dollar of income is taxed.

10 12 22 24 32 35 and 37. A progressive tax system means the lower an. You can learn a lot from online reviews but nothing replaces a personal conversation.

While the highest rate is 37 which is taxed on income thats between 510300 and 612350. A progressive tax system means the higher an individuals income the higher the percentage of income tax paid. 82500 38700 X 22 Fourth tax bracket.

The next chunk of your income is then taxed at 12 and so on up to the top of your taxable income. The way the government calculates tax returns A tax bracket is THE RATE AT WHICH INCOME IS TAXED. This is particularly important if youre looking for someone to partner with you for.

9525 X 10 95250. Here is how to accurately calculate your tax rate. According to the tax bracket the first 9950 is taxed at 10 the next 30574 is taxed at 12 and then only the additional 476 is taxed at 22 NOT the entire 41000.

For 2021 tax returns Sarah will pay 6749 in tax. How much tax will Stuart pay on this gain. 37 percent Percentage of respondents who answered correctly.

38700 9525 X 12 Third tax bracket. Jason wants to open a checking account with a 100100 deposit. The first is that there is a 0 bracket.

Between 200001 and 500000 your tax bracket is 35. To find out which tax bracket youre in youll need to start by calculating your taxable income your AGI. 0 - 9875 9876 - 40125 40126 - 85525 85526 - 163300 163301 - 207350 207351 - 518400 518401.

The rate of sales tax in a state C. 55000 x 12 6600. Stuart is in the 33 percent tax bracket.

Answer 1 of 4. Ad Compare Your 2022 Tax Bracket vs. Dslomer64 The reason for the 5 difference is that the tax tables are based on the middle of that small bracket.

Your 2021 Tax Bracket to See Whats Been Adjusted. Thats 9988 in this bracket. Select the best answer below price paid and the selling price.

The rate at which income is taxed B. Interest rate movements and bond prices are. Each category contains seven tax brackets.

A person with Taxable Income of 80049 should pay 13468 but per the tables will only pay the. Why not 12 Tax Bracket rate. Between 38701 and 82500 your tax bracket is 22.

What is the tax rate for the highest tax bracket in 2019. Continuing your example the tax on 80025 is 13464. An investors tax bracket will depend on their filing status and income.

128 The rate for the highest tax bracket dropped from 396. View the data on how taxes differ between states in this table. In short you are.

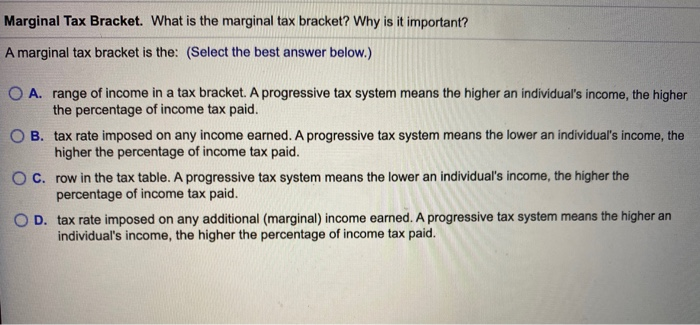

What is the marginal tax bracket. Why is it important. That is referred to as the marginal tax bracket.

That 55000 all falls within the 12 tax bracket and so is all taxed at 12. I got 141. There are two key points here.

Your 2020 tax rate. Range of income in a tax bracket. Here are the five filing status categories according to the IRS.

Log in for more information. IRS Tax Brackets. What amount of taxes will he pay on his capital gain if he held the stock for less than a year.

Your tax bracket is the rate you pay on your last dollar of income. 12 on the next 30575 40525-9950 22 on the remaining 9475 50000-40525 Add the taxable amounts for each segment 995 3669 2085 6749. In total Bens tax bill is.

My taxable income is 31000ish. 10 on the first 9950 of taxable income. For example if you are single the lowest tax rate of 10 is applied to the first 9950 of your income in 2021.

53550 x 12 6426. Ask for an Interview. Between 9526 and 38700 your tax bracket is 12.

What is a tax bracket. And the rest of Bens earningsfrom 85526 up to 100000are taxed at the 24 rate for in 3474 taxes. 8 Best Worst States to be a Taxpayer While everyone must pay taxes the types of taxes you pay and how much you pay in state and local taxes depend highly on the state you live in.

That is where most of the tax planning is focused -. That leaves 74100 20550 53550. The first 20550 is taxed at 10 generating 2055 in tax.

That 53550 all falls within the 12 tax bracket and so is all taxed at 12. It ranges from 10-37 depending on income and filing status. Jason believes he will write 1717.

Tax rate imposed on any income earned. Discover Helpful Information and Resources on Taxes From AARP. A marginal tax bracket is the.

115000 82500 X. The lowest bracket imposes a rate of 10 on income less than 9700. The tax rate of the highest tax bracket your income falls into is applied to your whole income.

Recently he sold stock that he had held longer than a year for a gain of 8600. 2055 6426 8481. Tax brackets show you the tax rate you will pay on each portion of your income.

Between 82501 and 157500 your tax bracket is 24. 1990 6600 8590. Capital gain18-126 Total gain610060.

Select the best answer below inversely related. The federal income tax brackets for 2020 and 2021 are 10 12 22 24 32 35 and 37. Next comes the 22 rate which applies to dollars from 40126 to 85525.

Over 500001 your tax bracket is 37. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widower. Between 157501 and 200000 your tax bracket is 32.

Tax Deducted At Source Tds Is A System Introduced By Income Tax Department Where Person Responsible For Making Spe Tax Deducted At Source Income Tax Payment

Solved An Investor Is In The 28 Tax Bracket And Lives In A Chegg Com

Solved Marginal Tax Bracket What Is The Marginal Tax Chegg Com

Comments

Post a Comment